Why create a new currency?

•This becomes a new financial credit instrument for investment grade organizations that is substantively less expensive than current methods due to the removal of interest fees and re-payment terms – – – it’s money.

•First true stablecoin. A crypto-currency that will become a market standard due to the effective absence of volatility. The underlying asset is the bank authorized credit of investment grade organizations. A currency that will be stable and safe to use for trade.

- A boon to smaller corporates – in a trade finance scenario, large buyers can pay immediately to smaller sellers, thus saving the cost of financing their payables (e.g. factoring)

Ultimate Objective

• Create electronic money – for general use

• A Digital Currency (corporate coin) on the Blockchain that is at least as useful, stable, scalable and acceptable as the current preeminent forms that exist today: FIAT currencies like the US$, and EURO.

• This currency will be fully backed by highly rated corporates and banks.

• Evolution of two ecosystems

• Create Coins: Low cost credit vehicle for major corporations by offering a fungible corporate coin (crpcred), as opposed to traditional financing (e.g., Commercial Paper, Bond, etc.)

• Utility Coins: Can be used as a stable medium of exchange for any transaction (e.g. Bitcoin like environment, trade finance …)

• Option to discount into FIAT currencies – a service provided by member banks (effectively an inexpensive factoring facility).

• Float into many markets for general purpose use – By building and operating this solution (the corporate coin creation/redemption)

Reduce fees, FX and financing costs associated with B2B transactions

The ultimate objective of CorpCoin it to create electronic money for general use. A digital currency (Corporate Coin) on the blockchain that is at least as useful, stable, scalable and acceptable as the current preeminent forms that exist today: FIAT currencies such as the USD or the EUR. This digital currency will be fully backed by the highly rated Corporations and Banks.

The evolution of two ecosystems, a) creating coins, as a low cost credit vehicle for major corporation by offering a fungible corporate coin, as opposed to using traditional financing such as Commercial Paper, Bonds, etc. and b) establishing utility coins which can be used as a stable medium of exchange for any transaction.

In addition, offering the option to discount into FIAT currencies, a service provided by member banks (effectively an inexpensive factoring facility), as well as floating the coins into many markets for general purpose use.

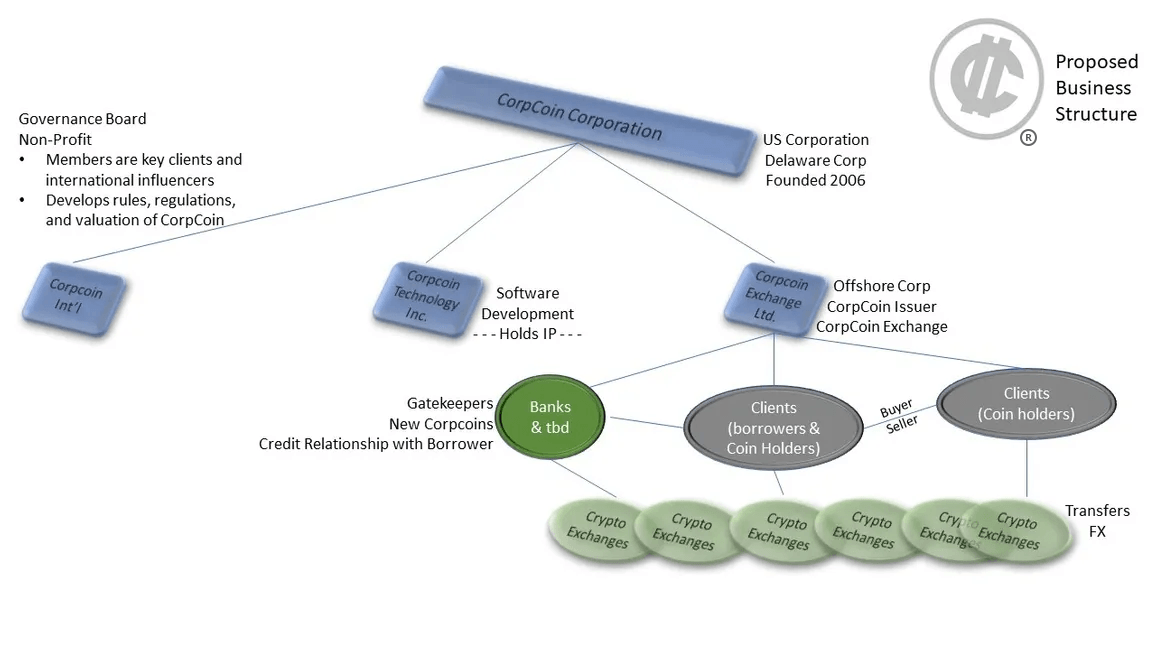

Ecosystem Players

Client/Borrower

Requests Corpcoins against their credit line. Uses to pay or purchase.

Bank

Client/Borrower approaches bank for Corpcoin. Contract (not unlike commercial paper) agreement made (bank charges points and no interest). Bank, if it has a shortfall of Corpcoins, can request new issuances from Gatekeeper.

Gatekeeper/Corpcoin Exchange

Charges for Corpcoins – new issue, destruction, transfers (only banks can request new issuance, and are responsible for their value, credit backed by the contractual relationship with Client/Borrower)

Client/Coin Holder

Wallet holder – pay other wallet holders in Corpcoins to settle debts and/or pay for purchases (smart contract options available)

Wallet

Facilities use to hold accounts of holders (DLT) of CorpCoin (perhaps on Ethereum platform initially)

Exchanges

Authorized to trade CorpCoin

Corpcoin Holding

Ultimate owner of Corpcoin service companies

Governance / Corpcoin Int’l

Key banks and stakeholders – Evolve rules, regulations, and value system for CorpCoin.